Author: Serkan ORHON / Business Unit Manager, Financial Solutions

Explore the world of EMV technology and its impact on payments. From the basics of what EMV is and how it works, to the benefits it provides such as increased security and global acceptance. Discover the implementation process, the concept of liability shift, and the challenges businesses face when adopting EMV. Get a glimpse into the future developments and conclude with the overall impact and effectiveness of EMV technology.

Introduction to EMV Technology

What is EMV?

EMV stands for Europay, Mastercard, and Visa, the three companies that developed the technology. It is a globally recognized standard for secure payments.

Purpose of EMV Technology

EMV technology aims to increase payment security and reduce fraud by replacing traditional magnetic stripe cards with chip-enabled cards.

How EMV Works

EMV cards have a microchip that generates a unique transaction code for every purchase, making it difficult for hackers to duplicate the data. The card is inserted into a chip-enabled terminal and verified through a secure authentication process.

Benefits of EMV Technology

- Increased Security: EMV cards provide enhanced security features, making it significantly more difficult for fraudsters to steal card data and create counterfeit cards.

- Fraud Prevention: The chip technology in EMV cards makes it extremely difficult for criminals to replicate or skim the card data, reducing the risk of fraudulent transactions.

- Global Acceptance: EMV technology is widely accepted internationally, allowing cardholders to use their chip-enabled cards seamlessly when traveling abroad.

EMV Implementation Process

- Chip Card Issuance: Banks and financial institutions issue EMV chip-enabled cards to replace traditional magnetic stripe cards.

- Upgrading Payment Terminals: Merchants and businesses update their payment terminals to accept chip-enabled cards and comply with EMV security standards.

- Training Staff on EMV: Employees are trained on how to handle chip-enabled cards and guide customers through the new payment process

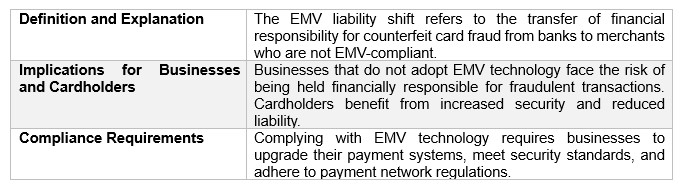

EMV Liability Shift

Challenges and Considerations in Adopting EMV

- Cost and Complexity, implementing EMV technology involves significant costs, including hardware upgrades, staff training, and compliance requirements, which can be complex for small businesses.

- Consumer Education, cardholders need to be educated about the benefits and usage of chip-enabled cards to ensure a smooth transition and minimize confusion.

- Integration with Existing Systems, integrating EMV technology with existing point-of-sale systems and software can be challenging, requiring careful planning and coordination.

Future Developments in EMV Technology

Contactless Payments

EMV technology continues to evolve with the introduction of contactless payments, allowing users to make secure payments by tapping their cards or smartphones on compatible readers.

Mobile Payments

The rise of mobile wallet applications enables users to make EMV-compliant payments using their smartphones, offering convenience and enhanced security.

Biometric Authentication

Biometric technologies, such as fingerprint and facial recognition, are being integrated into EMV cards and devices to provide an additional layer of security for transactions.

Conclusion

EMV technology has revolutionized the payment industry, enhancing security, reducing fraud, and providing global acceptance. Despite challenges in implementation and adoption, the overall impact of EMV is highly positive. As technology continues to advance, contactless and mobile payments, along with biometric authentication, will shape the future of secure and convenient transactions.