Author: Serkan ORHON / Business Unit Manager, Financial Solutions

In fact, there are other card schemes around the world that operate on similar logic (Visa, MasterCard, Amex, Discover, JCB, and others), but the most common ones internationally are MasterCard, Visa, and American Express.

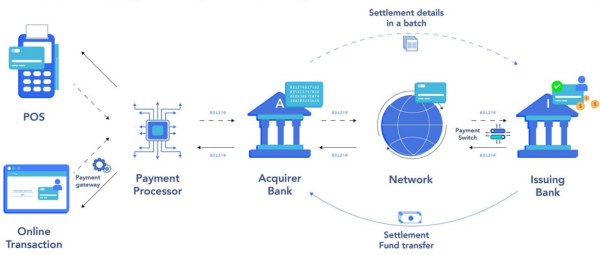

A card transaction requires at least three important stakeholders (as well as the customer and the merchant) and a reliable and secure internet connection for the needed data to flow through the system.

The three primary stakeholders are:

- the issuing bank (issuer): the bank that guarantees the user’s account, debit card, and/or credit card.

- the acquiring bank (acquirer): the bank that holds the merchant account and provides merchants with the instruments that they need to take payments.

- Card scheme: it establishes and handles communication between issuing and acquiring banks. In essence, it serves as a structure for the transaction.

Card schemes are classified into two types based on how they operate. Amex belongs to the closed card networks, which implies it is also a bank and functions as both an issuer and an acquirer, whereas Visa and Mastercard belong to the open card networks, which act more like marketplaces with various acquirers and issuers. This post will concentrate on the two major open card networks, Visa and Mastercard.

The acquirer processor serves as the link between the merchant, the acquirer, and the card scheme. Similarly, the issuer processor serves as a conduit between the issuing bank and the card scheme. Both processors receive and send data to and from card schemes and require a piece of hardware to connect directly to the card schemes.

The Dual-Message The most common type of card transaction is known as a signature transaction, so named because the process is divided into two messages: the authorization (also known as the initial message), which takes place when we use our cards, and the clearing (the second message), which usually takes place in large quantities over the next 24-48 hours.

The single-message transactions have that name because the funds are authorized, cleared, and settled in real time (through a single message). A single-message transaction is one that occurs at ATMs when we withdraw cash from our bank accounts.

Card Transaction Process

Authorization process

So, to begin delving further into the Authorization process, consider the following offline card transaction:

- The consumer wishes to purchase a coffee from a cafe and swipes their credit or debit card through a POS (point-of-sale) terminal (or a device that records the customer’s card information).

- The POS transmits the customer’s card information to the acquiring processor.

- The acquiring processor captures the transaction, determines which card scheme the individual card belongs to, and passes the information to the applicable card scheme (e.g., Visa, Mastercard).

- The card network determines the issuer (based on the first six digits of the BIN) and passes the transaction to the issuer processor, who sends the information to the issuing bank (the customer’s bank or issuer) and asks for authorization. The transaction is accepted or rejected based on the availability of funds and the cardholder’s account status.

- The issuing bank (the customer’s bank) transmits the response back to the issuer processor, who then sends the information to the card scheme network. If the permission is approved, the issuing bank assigns and transmits an authorization code along with its response, and the customer’s money is placed on hold.

- The card network forwards the permission to the acquirer processor, who forwards it to the cafe’s POS.

Clearing Process

The amount of the transaction appears as a “pending transaction” on the customer’s bank account once the authorization process has completed and the customer has received their coffee. By the end of the day, the café (merchant) has typically either manually or automatically confirmed the validity of the transactions (the clearing procedure). The settlement refers to the actual transfer of funds from the issuer (the customer’s bank) to the acquirer (the café’s bank) as directed by the card scheme.Revenue sources for each stakeholder.

Card schemes:

In our case, Visa and Mastercard earn money from merchants and issuers since they are located in the heart of the payment system.

Fees charged by card networks to issuers:

- Every time a message passes via the card network, there is a use fee. As a result, a dual message is charged twice.

- Once the transactions are cleared, the card network charges the issuer a reported settlement cost (usually a fixed price per transaction).

- Other SaaS-type fees for services such as settlement and/or fraud.

Fee charged to merchants by card networks through acquirers:

- The network assessment fee is one of the fees charged on the merchant and is deducted from the transaction value.

Issuers:

Fee charged by issuing banks to merchants via acquirers:

• Interchange costs are determined by a huge variety of complex criteria (card type, firm size, industry, and so on).

The interchange fees are determined by the card systems and are not negotiable for merchants. The interchange fees are shared based on the number of service providers on the bank’s side, and there may be additional fees between the issuing bank and the service providers.

Acquirers:

The Acquirers impose various fees to Merchants, however the following are the main ones:

• The acquirer fee (or acquirer markup) is a flat cost charged by the Acquirer at the end of the month.

• Additional fees may be imposed for services such as refused cards, chargebacks, and so on.

• Either a commission through a reseller agreement or a margin off of the hardware (POS).

The fees are shared based on the role of each provider depending on the number of service providers on the acquiring side. Acquiring fees are negotiable, and retailers can save significant money by reviewing and comprehending their monthly bills.

The expense of taking card payments by the merchant

As we can see, it is difficult for a merchant to have a good view of the whole cost of accepting card payments. Acquirers do not consistently display their pricing, making it difficult for businesses to determine which is the more cost-effective option for them. The ultimate transaction cost is determined by a variety of criteria, including the acquirer, the region, the kind of merchant, transaction, card, and many more.

When it comes to accepting Visa and MasterCard cards, there are two popular pricing models: Interchange and Blended.

When compared to Blended, Interchange is more transparent. It provides a full breakdown of the three major payment card charges stated previously: the card scheme fee, the interchange fee, and the acquirer markup. Because costs vary depending on a variety of conditions, they may be lower or greater than a fixed rate.

Blended charges a predetermined markup plus an average processing fee. The merchant is charged the same markup on every transaction and is unaware of the cost split.

Chargeback

Chargeback is a technical word used by international card schemes to describe the refunding process for a card transaction that occurred due to a rule violation. Originally, chargeback was a method designed by card issuers to safeguard consumers in the event of fraudulent card authorization (for example, as a result of theft or card cloning).

When cardholders do not recognize a charge in their account, they can request a refund from their bank (issuing bank). Furthermore, chargebacks include situations in which the purchased goods or service was never delivered or was of lower quality than expected, and the merchant refused to refund the money. When customers commence the chargeback procedure, their cards are usually canceled and their banks (issuing banks) issue new ones.

The liability rules and the actual process vary depending on several aspects (region, type of transaction, etc.), but normally the chargeback is paid by the merchant or the card issuer. The card issuer will determine (mostly or entirely, depending on the rules) how much obligation will rest on the cardholder. Chargebacks are not compensated by the card networks.

Merchants must maintain chargebacks under 1% or risk losing their ability to accept card-based payments through their acquirer. As a result, they are incentivized to employ safer payment methods (for example, paying with an EMV chip in offline transactions). This is due to the rigorous rules imposed by the card schemes on the acquirers.

The Conclusion

The operations described above are closer to simple offline transactions, but the variations between them and online transactions are minor. The truth is that most of the time, both for offline and online transactions, there are many more service providers in the broader payments ecosystem, both on the acquiring and issuing sides. The only thought you should have is about bringing in a suitable payment processor to make your credit card transactions occur in a fraction of seconds for a lower fee.