Author: Serkan ORHON / Business Unit Manager, Financial Solutions

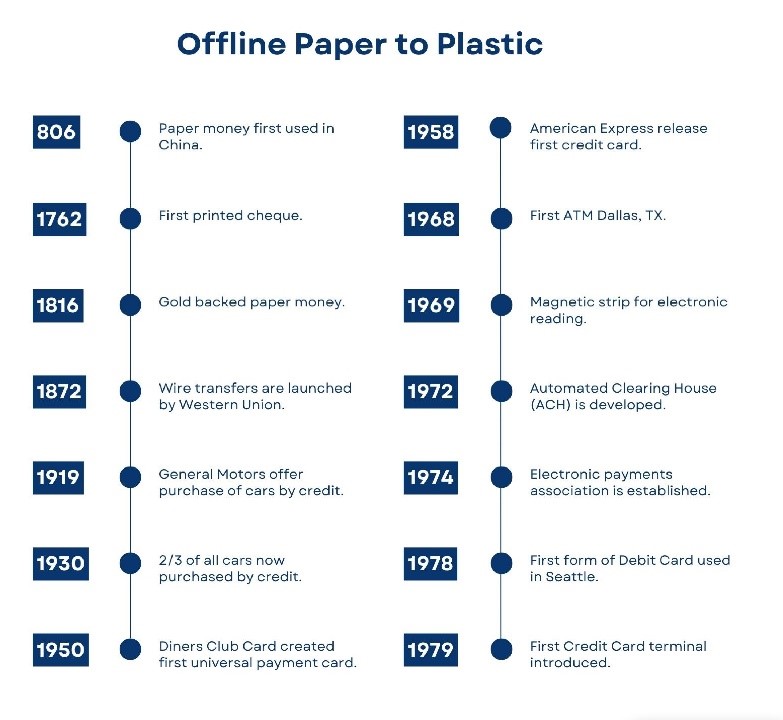

Payments have evolved significantly throughout time. The graphic below show the evolution of paper money from its first use in 806 to cheques, wire transfers, credit payments, and finally a variety of plastic payment systems up to 1979.

The Diners’ Club issued the first card in history in 1950. For businessman Frank McNamara, leaving his wallet at a New York City restaurant was an embarrassment he resolved never to repeat. Fortunately, his wife arrived to bail him out and pay the bill. But he had no idea that dinner would become a significant part of his credit card history. He returned to Major’s Cabin Grill with his partner Ralph Schneider a year later, in February 1950.

Membership reaches 42000 as acceptance expands to major US cities, bringing together a new kind of community in 1951.

McNamara paid the charge with a little cardboard card known now as a Diners Club Card. The event was dubbed the “First Supper,” and it helped pave the way for the world’s first multipurpose charge card.

In the 1960s, Bank of America issued 1M cards and licensed them in the United States. In the 1970s, almost 3000 banks were licensed, and Bank of America branded this service as Visa.

Mastercard, formerly known as Interbank from 1966 to 1969 and Master Charge from 1969 to 1979, was founded by an alliance of numerous regional bankcard organizations in response to the “BankAmericard” provided by Bank of America, which subsequently became the Visa credit card issued by Visa Inc.

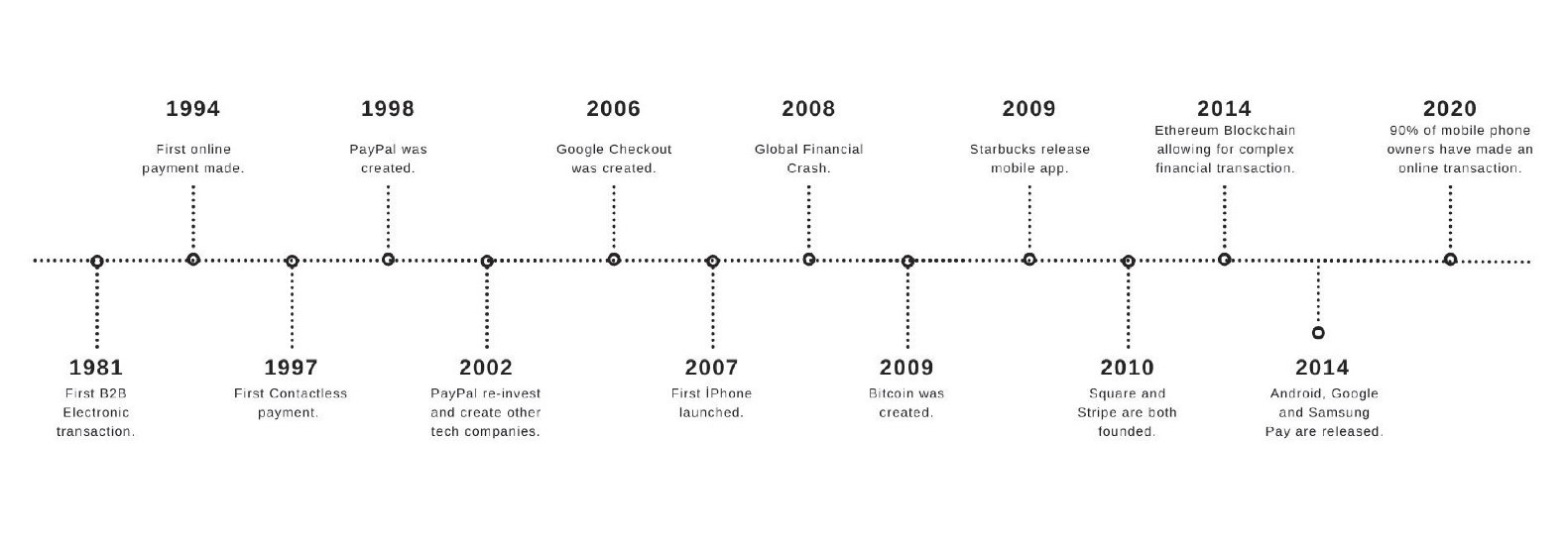

Payments quickly followed the development of the internet and the shift of business online. The first B2B electronic transaction was made in 1981, as shown in the graphic below. After the internet became available in 1991, the first online payment was made by a consumer in 1994. Following the establishment of Amazon, Google, and PayPal, the e-commerce sector became considerably more accessible. Online payments were simpler, more convenient, and more secure. With the introduction of the smartphone in 2007, customers gained the option to shop online directly from their pockets without the use of a PC. Payment patterns were set to change. Payment laws were tightened as a result.

Evolution of Electronic Payment Trends

In the United States, electronic payments have skyrocketed in the recent decade. Over the previous five years, ACH payments (electronic transfers) have increased year after year. ACHs are increasingly challenging the most prevalent form of payment, checks. As the data below show, ACH payments will overtake checks and become the dominant payment method in the coming years. Checks are still commonly used, and banks offer a service called ‘Lockbox Banking’ to help consumers process checks. Banks will pick up your checks from a specified location, process them, and deposit them into your business accounts. Due to bank lockbox keying fees, this operation can be rather costly.

Mobile Technology Payment Trends

Smartphones began available in 2007. They paved the way for larger internet payments. This resulted in rapid advancements in mobile payment technology and infrastructure. We’ve highlighted some of these developments below.

Mobile Wallet: A virtual wallet that stores payment card information. You can make, share & receive payments along with an e-cash solution.

Payments in Apps: If online shopping on your phone. Card details are entered upon checkout. OCR technology can also scan your card.

Mobile POS: Square technology allows payments to be taken by connection hardware to a mobile device.

Carrier Billing: Add payments for goods & service to your phone bill. Such as adding Amazon Prime of Spotify to your bill.

NFC: Allows you to make a payment by holding your phone over the payment terminal.

Online Payment Services: PayPal stores your card data securely and you can pay on most websites with the click of a button.

Mobile P2P Transfer: Users can transfer Money to other accounts by using a banking or 3rd party app.

WeChat: A Chinese mobile super-app. Communication, fitness, gaming, search engine, banking, NFC, etc.

The Future of Payment Trends

1. E-commerce skyrockets

The global e-commerce market climbed 19% to $4.6 trillion, the fastest rise in the previous five years. This is nearly three years of normal acceleration in a single year. According to our projections, e-commerce will rise by 60% by 2024, primarily due to mobile commerce via apps and social platforms, reaching an estimated $7.3 trillion globally.

We expect this trend to continue through 2024 as customers get increasingly comfortable making purchases online and on mobile devices. As e-commerce and mobile commerce gain traction in the coming decade, merchants will need to plan for online and mobile devices as the primary point of purchase and design compelling, channel-agnostic, and unified experiences for all consumers.

2. Mobile wallets are no longer an alternative option

Mobile wallets will overtake credit cards as the most popular online payment method by 2024, accounting for more than one-third of all payments at that time. Mobile wallets are expected to overtake conventional cards as the most common online payment option in the United States over the next three years.

If this trend continues, we expect digital wallets to completely digitize credit cards within the next decade. Surprisingly, retailers are already catching on to this trend, with online marketplaces booming to record heights.

3. The cashless society of the future is now a reality

In 2020, cash accounted for just one-fifth of all in-store payments globally, trailing significantly behind credit cards (50% of in-store payments) and mobile wallets (26%). Within the next five years, we expect cash will account for less than 13% of payments worldwide.

4. Buy now, pay later (BNPL) is now the fastest-growing payment method

BNPL is expected to be used for $306.8 billion in e-commerce transactions by 2024, up from $97.2 billion in 2020. The cause is that more customers are using BNPL to manage their costs of purchases immediately at the point of sale, helping them to budget and maintain financial management.

5. Digital wallets go from bank card to bank account

An increasing number of mobile wallets are being financed directly from bank accounts as a result of legal developments and increased acceptance of open banking. More than half of users in South Africa, Thailand, Finland, Vietnam, the Netherlands, and Norway already finance their digital wallets using their bank accounts. Less than a third of users in the UK, US, and Australia fund their digital wallets directly from their bank accounts, while physical debit and credit cards continue to fund more than half of all digital wallets worldwide. By the end of the decade, we anticipate that those percentages will change as Western customers grow accustomed to using account-to-account based wallets.

So, do not delay the future by postponing today. We are one contact away and waiting to help you to catch the future and to serve your and your customers’ best interests payment solutions.